Strategic Financial Solutions for Manufacturing Company: Case Study

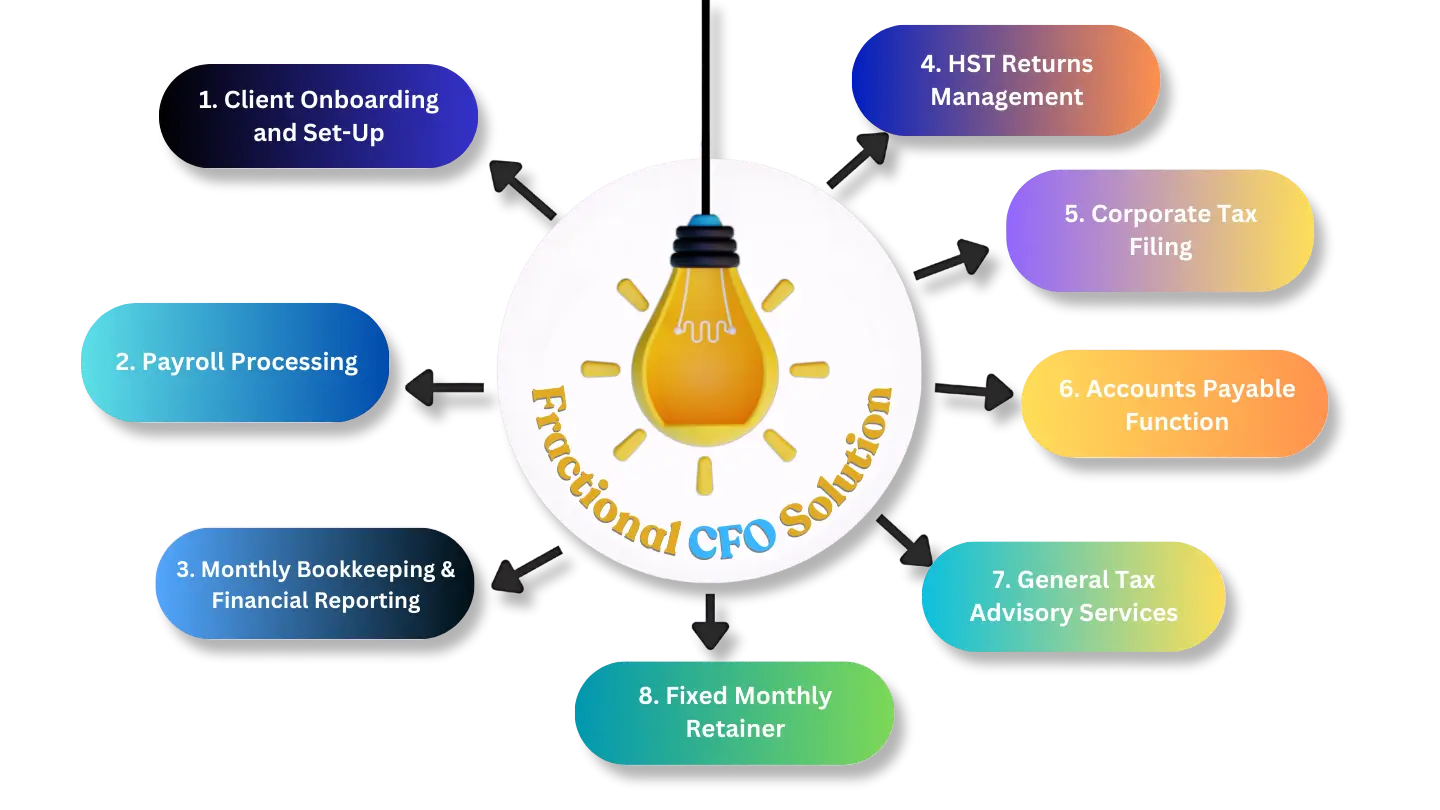

Overview A rapidly growing manufacturing company in Ontario faced significant financial challenges that threatened its survival. By partnering with SDG Accountant, the top accounting firm