What Kind of Slips is Applicable to Me or My Employees?

Whereas employees generally receive T4 slips, shareholders who pay themselves dividends should be receiving T5 slips. We will identify what kind of slips you need for year-end and ensure your summaries are filed with CRA.

The general deadline for filing summaries is the last day of February of the following calendar year to which they apply (February 28 unless leap-year*).

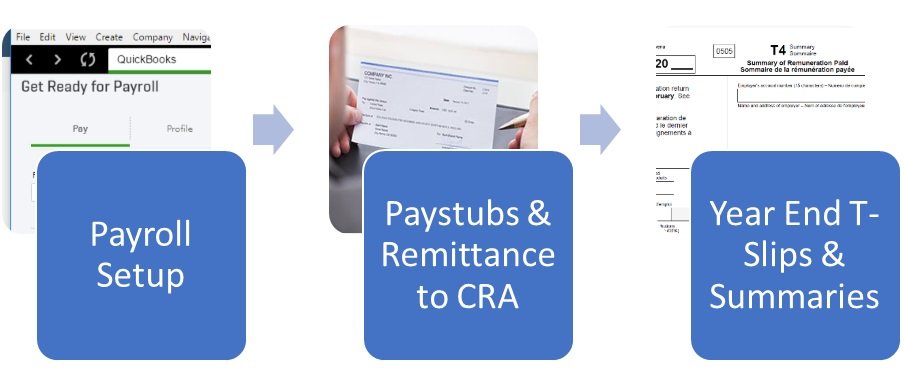

Payroll Software Selection

Whether you are choosing to use Wagepoint, Quickbooks Online (QBO), Simple Pay, Wave, or Payment Evolution we are here to help guide and select the right payroll provider software for your small business.

Whether you are choosing to use Wagepoint, Quickbooks Online (QBO), Simple Pay, Wave, or Payment Evolution we are here to help guide and select the right payroll provider software for your small business.

Each software has different capabilities and features. Some can offer direct deposit for your employees (to eliminate checks) and others can automatically remit source deductions to CRA (without having to pay through your online bank or visiting the branch).

We will help set up and integrate your software solution into your accounting system to ensure your accounting system is tracking your payroll liabilities and recording your payments to ensure accurate financial reporting.

Payroll Remittance Types

For small businesses, there are usually 3 options for remitting periods. The most common is a regular remitter who must make monthly remittances.

Type | Average Monthly Withholding Amount (AMWA) | Frequency | Due Dates |

Regular | 0 to $24,999.99 | Monthly | 15th day of the next month |

New Small Employer* | N/A – Total Monthly withholding amount is = 0 to $999.99 & Perfect Compliance History | Quarterly | 15th day of the next month of that quarter |

| Account Opened for the minimum of 12 months or Longer | 0 to $2,999.99 & Perfect Compliance History | Quarterly | 15th day of the next month of that quarter |