The CRA Voluntary Disclosure Program grants relief to taxpayers who voluntarily omitted or made an error on their tax returns. In the program, taxpayers can correct or make changes to their previous year returns.

What Types of Relief can the Voluntary Disclosure Program Provide?

- Prosecution relief

- Penalty relief

- Partial interest relief

However, these reliefs are provided on a case-to-case basis. Not every taxpayer will be able to obtain all these reliefs.

The CRA grants a higher level of relief to those who unintentionally made an error than those who purposefully avoided their tax obligations.

Should You Apply for the Voluntary Disclosure Program?

This program can receive a wide range of tax situations. The below list a few of the most common scenarios:

- A mistake was made on a previous year tax return

- A tax return was not filed previously and is now considered as late

- Foreign income that is taxable in Canada was not reported in a prior tax return

- Required information such as (Form T1135, Foreign Income Verification Statement) was not provided[1]

- GST/HST was not collected, remitted to the CRA or charged to consumers[2]

- Ineligible GST/HST input tax credits, refunds or rebates were claimed

If clients are unsure whether or not they made a mistake or omitted required information. A free consultation can be booked or contact SDG Chartered Professional Accountant at admin@sdgaccountant.com for any inquiries.

What Are the Conditions for a Valid Application?

- Be Voluntary – Taxpayers who received notice from the CRA do not qualify for the Voluntary Disclosure Program. Only taxpayers who voluntarily come forward to make changes to their errors or want to include omitted errors are qualified for this program.

- Penalty Owing – The omitted or inaccurate information must result in a penalty or interest owing to qualify as a valid application for the Voluntary Disclosure Program.

- Include Payment – An estimated amount of tax owing must be attached to the Voluntary Disclosure Program application during submission.

- Full Transparency – Submission of evidence and thorough explanation of omission or error must be attached to the application.

- Past Reporting Period – The omitted information or error made must be at least past one reporting period.

Submission Details

The Voluntary Disclosure application should include:

- Form RC199 – Voluntary Disclosures Program Application

- Payment of estimated tax owing

- Evidence or statements on the errors made or information omitted

It is important to note that not all Voluntary Disclosure applications will be approved by the CRA. Taxpayers can improve the chances of their applications being successful by inquiring about professional help.

A free consultation can be booked or contact SDG Chartered Professional Accountant at admin@sdgaccountant.com for assistance in VDP applications.

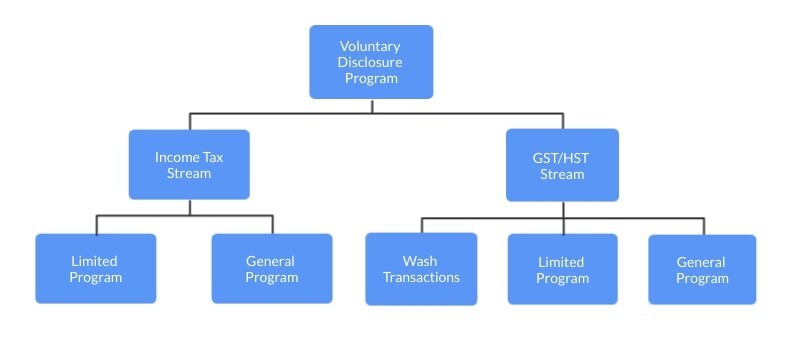

Overview of the Voluntary Disclosure Program

The Voluntary Disclosure Program (VDP) is segregated into two different streams, the income tax stream and the GST/HST stream.

1. Income Tax Stream

The income tax stream is further divided into the (a) Limited program and the (b) General program.

- Limited Program – This program applies to taxpayers that:

- Intentionally avoided their tax obligations

- Corporations with gross revenue exceeding $250 million in at least two of the last five fiscal years

Taxpayers who come forward may not be charged with gross negligence penalties or be referred for criminal prosecution. However, they will still be required to pay interest penalties.

- General Program – Taxpayers who unintentionally made an error or omission fall under this category. Taxpayers will not be charged penalties and will be provided partial interest relief for the years preceding the three most recent years of returns required to be filed.

2. GST/HST Stream

This section applies to taxpayers with tax situations related to GST/HST, excise tax, excise duty, softwood lumber products export charge and air travellers security charge disclosures.

- Wash Transactions – Taxpayers who fail to charge, collect GST/HST from a registrant entitled to a full input tax credit fall under this category.

- Limited Program – This program applies to taxpayers that:

- Intentionally avoided their tax obligations

- Corporations with gross revenue exceeding $250 million in at least two of the last five fiscal years

Taxpayers who come forward may not be charged with gross negligence penalties or be referred for criminal prosecution. However, they will still be required to pay interest penalties.

- General Program – Taxpayers who unintentionally made an error or omission fall under this category. Taxpayers will not be charged penalties and will be provided partial interest relief for the years preceding the three most recent years of returns required to be filed.

The CRA will also take into consideration the sophistication of the taxpayer, amount of omission, and the number of years of omission when classifying taxpayers into different categories. At SDG Accountant, our Toronto Tax Accountant can assist you in determining which stream is appropriate for your disclosure and that all the necessary information is included.

Although the VDP is a very beneficial resource, it is essential to disclose your tax issues with a tax accountant to ensure that your omitted income does qualify for the disclosure program or if there are any other relevant tax treaties and provisions that can lead to a more favourable conclusion.

SDG Accountant can ensure you have thoroughly and accurately complied with all the conditions that must be met to submit an authentic disclosure. Our offices in Toronto can provide all the steps to submit a successful VDP, including tax owing estimates, unfiled income tax returns, back taxes, unfiled HST, sales tax returns, any unreported income and unreported foreign assets on the T1135 form.

If you are interested in determining your eligibility for the Voluntary Disclosure Program, please contact our Toronto office directly by email: admin@sdgaccountant.com or by calling our office (416)-755-3000.

The information is not intended to constitute professional advice and may not be appropriate for a specific individual or fact situation. It is written by the author solely in their personal capacity and cannot be attributed to the accounting firm with which they are affiliated. It is not intended to constitute professional advice, and neither the author nor the firm with which the author is associated shall accept any liability in respect of any reliance on the information contained herein. Readers should always consult with their professional advisors in respect of their particular situations.

— Sami Ghaith

CPA,

CGA, MBA