Unlocking the Benefits of a Holdco

Are you a business owner in Toronto or its surrounding cities seeking ways to optimize your corporate structure? For many businesses, there are more benefits

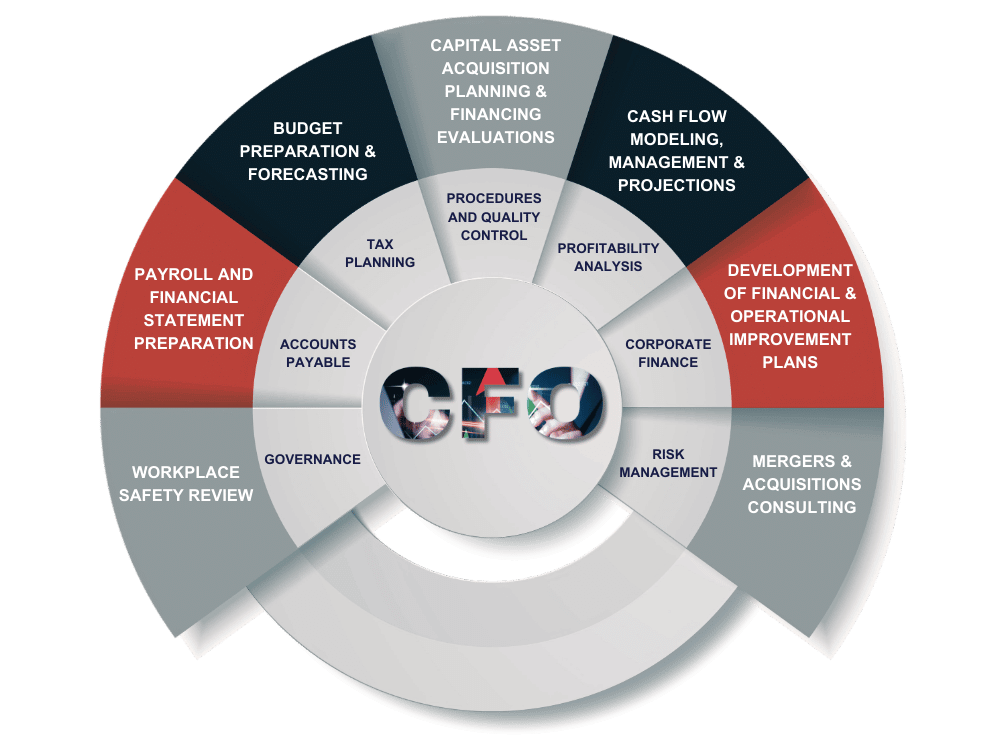

In today’s competitive business landscape, effective financial management is more crucial than ever. Companies need robust financial strategies to drive growth, manage risks, and stay ahead of the competition. As a leading multi-national accounting and practice firm headquartered in Toronto with a dedicated office in Florida, SDG Accountants offers comprehensive CFO outsourcing and controller services to help businesses achieve financial excellence without the overhead of a full-time executive team.

Do you need our outsourced CFO & controller services? Here are a few more common situations that have led to using our services.

A solid financial foundation begins with implementing controls that safeguard assets and ensure accurate financial reporting. Internal controls are essential for preventing fraud, reducing errors, and enhancing operational efficiency. At SDG Accountant, we specialize in designing and implementing control systems tailored to your business needs, providing peace of mind and ensuring regulatory compliance.

Are you a business owner in Toronto or its surrounding cities seeking ways to optimize your corporate structure? For many businesses, there are more benefits

An efficient accounting system is the backbone of any successful financial strategy. We offer accounting system consultation (including QuickBooks, Bench, Wave, etc.) and setup services to streamline your financial processes. Our experts assess your current systems, recommend improvements, and implement solutions that integrate seamlessly with your operations. This ensures real-time financial data access, enabling informed decision-making.

Effective budgeting and forecasting are vital for anticipating market trends and allocating resources wisely. SDG Accountant assists businesses in developing comprehensive budgets that align with their strategic goals. Our forecasting services provide insights into future financial performance, helping you prepare for potential challenges and opportunities.

Our financial planning services encompass a wide range of strategies to enhance your company’s financial health. From cash flow management to capital expenditure strategies, we tailor our approach to meet your specific objectives. In the realm of corporate finance, we offer advisory services on mergers and acquisitions, capital raising, and financial restructuring to support your growth initiatives.

Navigating complex accounting standards and regulations can be daunting. Our accounting advisory services provide guidance on compliance, financial reporting, and best practices. Additionally, we offer financial modelling to simulate various business scenarios. This aids in risk assessment and strategic planning, ensuring you make decisions backed by quantitative analysis.

Introduction: In this case study, we will look at a recent dispute with the CRA that our client won. Our accountants in Toronto are knowledgeable

By partnering with our Toronto Accountant, you gain access to seasoned financial professionals dedicated to your success. Our services are designed to be scalable, cost-effective, and customized to your unique business needs. Whether you’re a startup or an established enterprise, we provide the expertise required to drive financial excellence.

Additionally, we are available 24/7-365 days for all our clients.

Contact SDG Accountant today to learn how our CFO outsourcing and controller services can transform your financial operations and set your business on a path to sustained success. With offices in Toronto and Florida, we are equipped to serve clients across North America.

Outsourced CFO & Controller ServicesAt SDG Accountant, we are dedicated to assisting our clients in reaching remarkable results aligned with their business objectives. If you’re interested in discovering how our outsourced CFO services can benefit you, reach out to us today!

The advice on accounting, business, or tax matters provided in this article is not meant to be a comprehensive examination of particular issues, nor should it replace a formal opinion. It also may not be adequate to prevent tax-related penalties. If you wish, I can conduct the necessary research and furnish you with a thorough written analysis. This service would likely require a separate engagement letter outlining the scope and limitations of the consultation services requested.

The information is not intended to constitute professional advice and may not be appropriate for a specific individual or fact situation. It is written by the author solely in their personal capacity and cannot be attributed to the accounting firm with which they are affiliated. It is not intended to constitute professional advice, and neither the author nor the firm with which the author is associated shall accept any liability in respect of any reliance on the information contained herein. Readers should always consult with their professional advisors in respect of their particular situations.