A foreign tax credit is available to any taxpayer who has been a resident of Canada and earned worldwide income at any time during the tax year. The income...

The CRA Voluntary Disclosure Program grants relief to taxpayers who voluntarily omitted or made an error on their tax returns. In the program, taxpayers can correct or make changes...

What is RRSP and what are the Benefits? An RRSP account is a retirement savings plan that you can establish with qualified institutions such as banks, credit unions, trusts...

One of the most common questions we hear from our clients is “How Do I Make a Payment to the CRA?” Day in and day out thousands of hardworking...

Today’s discussion is on the topic of filing requirements, specifically on residency and how to determine what may affect your residency in Canada and the associated tax implications. We...

When we meet with clients who come in looking to file their personal tax returns, the first thing we check with every individual is what items are applicable to...

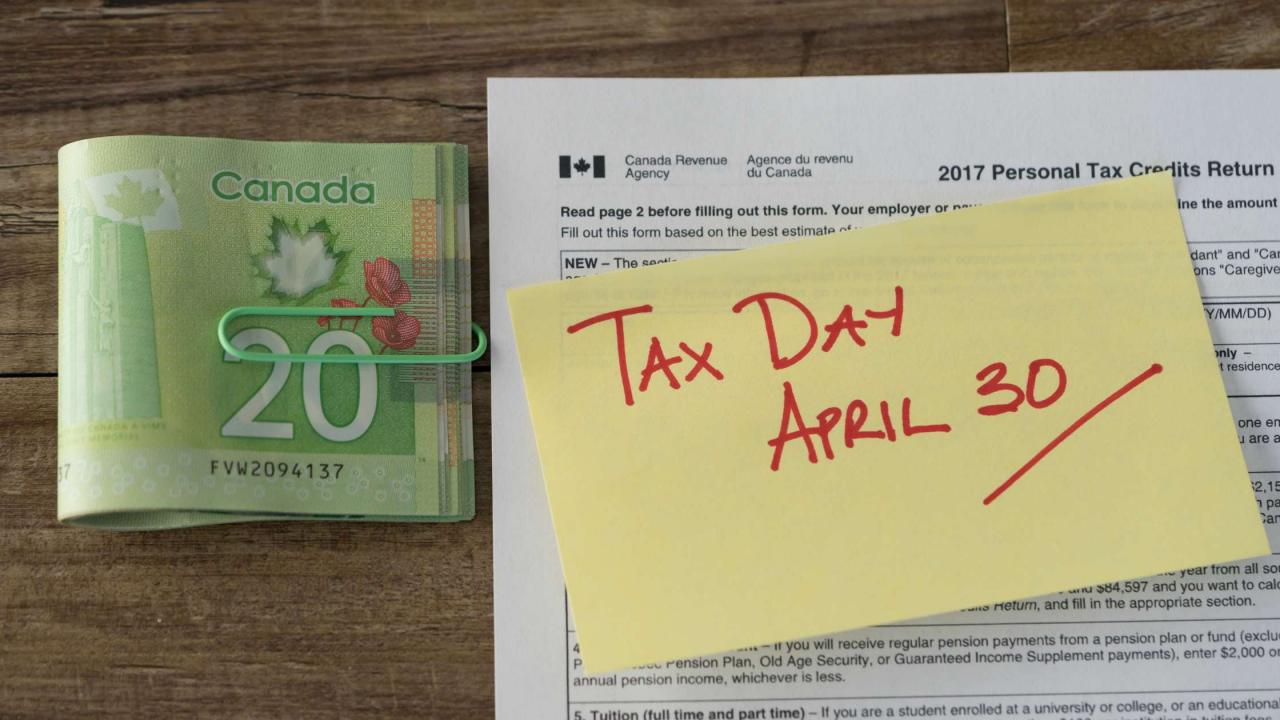

Are you required to file a Canadian Tax Return? As per the Government of Canada, for the most part, people living in Canada can determine their final tax obligation...

Operating a Business in Canada can be an exciting and rewarding prospect, but there are many issues that individuals need to keep in mind when building their enterprise. In...