Information on Personal Real Estate Corporations (“PRECs”) in Ontario

Brief Introduction The Government of Ontario has introduced new legislation as of October 01, 2020, bypassing Bill 45, Trust in Real Estate Act, 2020 which

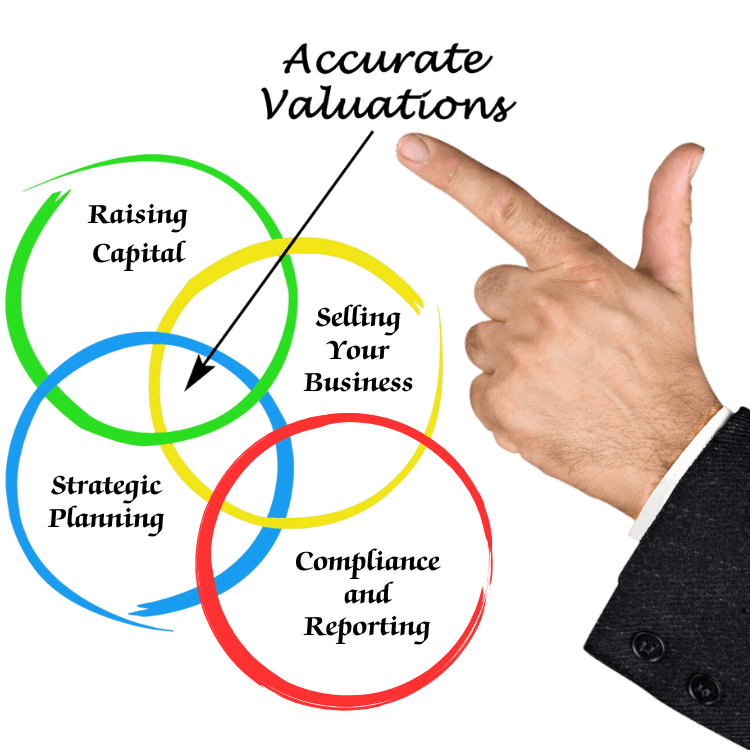

In today’s fast-paced business environment, knowing the true value of your company is more important than ever. Whether you’re aiming to raise capital or planning to sell your business, an accurate valuation is a critical component of your strategic decision-making process. At SDG Accountant, we bring decades of experience and have successfully advised on over $50 billion in transactions, offering comprehensive valuation services across all industries.

A precise valuation does more than just assign a value to your business; it provides essential insights that can drive growth and profitability. Here’s why a thorough valuation is indispensable:

Brief Introduction The Government of Ontario has introduced new legislation as of October 01, 2020, bypassing Bill 45, Trust in Real Estate Act, 2020 which

At SDG Accountant, we believe that an effective valuation is rooted in a deep understanding of your business. Our approach includes:

Maximizing Business Growth with SDG Accountant In today’s competitive business landscape, effective financial management is more crucial than ever. Companies need robust financial strategies to drive growth,

With a proven track record of over $50 billion in advisory work, SDG Accountant has been instrumental in helping businesses achieve their financial goals. Our expertise spans:

An accurate valuation is more than a number—it's a strategic tool that can unlock new opportunities for your business. Let SDG Accountant provide the expert guidance you need to navigate your next phase of growth confidently.

Growing Up Your BusinessContact us today to learn how our valuation, and business advisory services can help you achieve your financial objectives. Email us at admin@sdgaccountant.com or call us today at (416) 755-3000. Let SDG Accountant be your trusted partner in financial success.

The advice on accounting, business, or tax matters provided in this article is not meant to be a comprehensive examination of particular issues, nor should it replace a formal opinion. It also may not be adequate to prevent tax-related penalties. If you wish, I can conduct the necessary research and furnish you with a thorough written analysis. This service would likely require a separate engagement letter outlining the scope and limitations of the consultation services requested.

The information is not intended to constitute professional advice and may not be appropriate for a specific individual or fact situation. It is written by the author solely in their personal capacity and cannot be attributed to the accounting firm with which they are affiliated. It is not intended to constitute professional advice, and neither the author nor the firm with which the author is associated shall accept any liability in respect of any reliance on the information contained herein. Readers should always consult with their professional advisors in respect of their particular situations.