Foreign Tax Credit: Your Guide to the Form 1116

The IRS offers a way for expats to avoid paying two levels of tax on the same income. Provisions that enable this are the foreign

As an American living in Toronto, you may be required to file taxes in both the United States and Canada. This is because the US taxes are based on citizenship, not residency, which means that all US citizens, regardless of where they live in the world, are required to file U.S. taxes. Here’s what you need to know about filing US taxes as an American living in Toronto.

The first step in filing US taxes as an American living in Toronto is to determine your filing requirements. If you meet the IRS filing threshold, you will need to file a US tax return, regardless of where you live. The filing threshold varies depending on your filing status, age, and income level.

The next step is to gather all of your tax documents, including your W-2, 1099, and any other forms that report your income. If you are self-employed, you will need to gather all of your business records, such as invoices and receipts.

As an American living in Toronto, you may be eligible for the foreign earned income exclusion, which allows you to exclude up to a certain amount of your foreign earned income from US taxation. To qualify for the exclusion, you must meet certain requirements, such as a minimum physical presence in the foreign country.

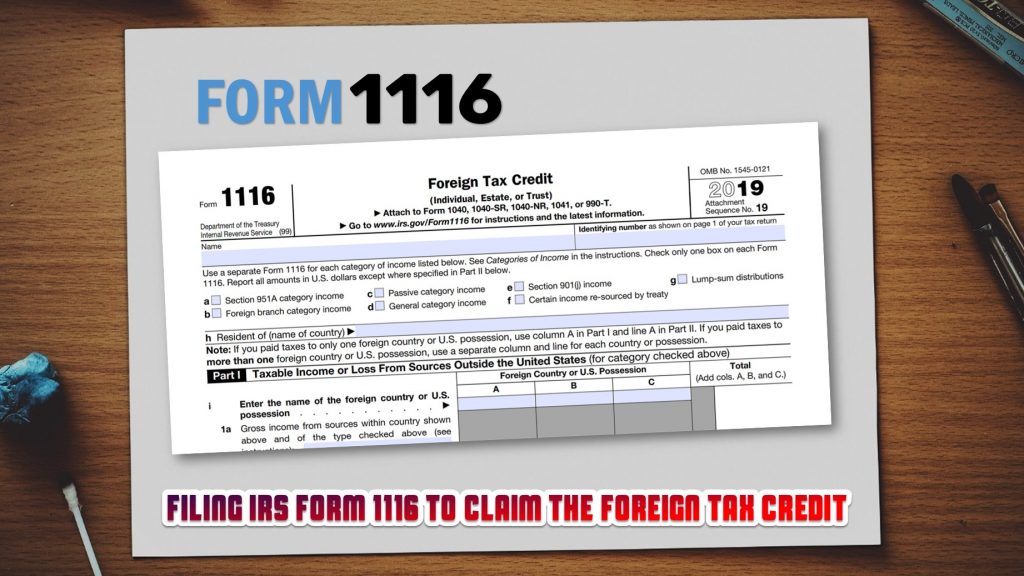

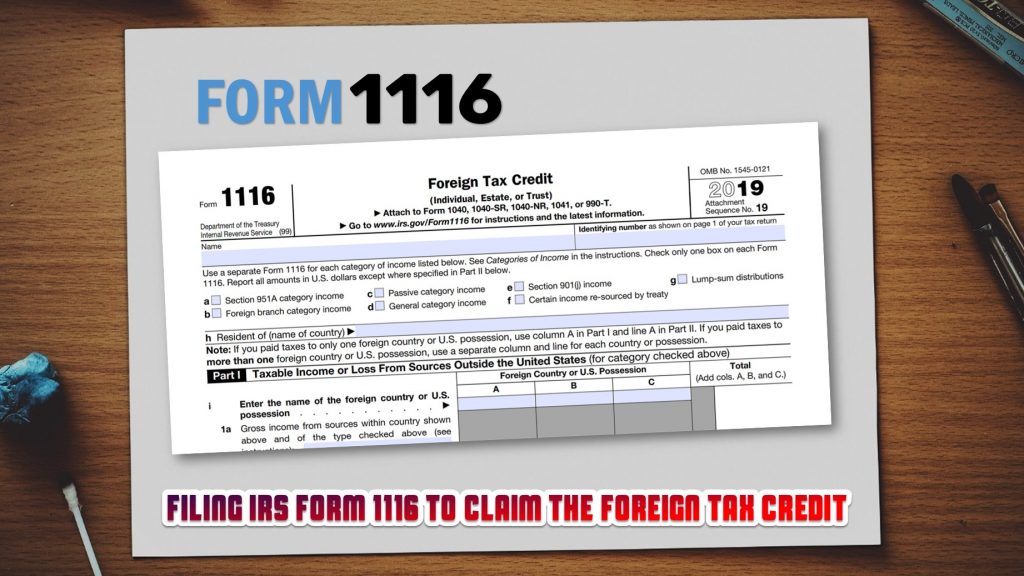

If you paid income tax to the Canadian government, you may be able to claim a foreign tax credit on your US tax return. This credit reduces your US tax liability and can help to offset any Canadian tax you paid.

The IRS offers a way for expats to avoid paying two levels of tax on the same income. Provisions that enable this are the foreign

Once you have gathered all of your tax documents and determined your foreign income exclusion and foreign tax credit, you can file your US tax return. You can file electronically or by mail, depending on your preference. Be sure to keep a copy of your tax return for your records.

If you have more than $10,000 in foreign financial accounts, you may be required to file a Foreign Bank Account Report (FBAR) with the US Treasury Department. This report must be filed separately from your tax return and is due by April 15th each year.

Expats who have foreign financial accounts may need to look into FBAR requirements. If they meet the eligibility criteria, they must file an annual informational

Filing US taxes as an American living in Toronto can be a complex process, but with careful planning and preparation, it can be done effectively. By following these steps and seeking the advice of a qualified tax professional if needed, you can ensure that you remain in compliance with all US tax laws and regulations.

The information is not intended to constitute professional advice and may not be appropriate for a specific individual or fact situation. It is written by the author solely in their personal capacity and cannot be attributed to the accounting firm with which they are affiliated. It is not intended to constitute professional advice, and neither the author nor the firm with which the author is associated shall accept any liability in respect of any reliance on the information contained herein. Readers should always consult with their professional advisors in respect of their particular situations.

— Sami Ghaith

CPA, CGA, MBA