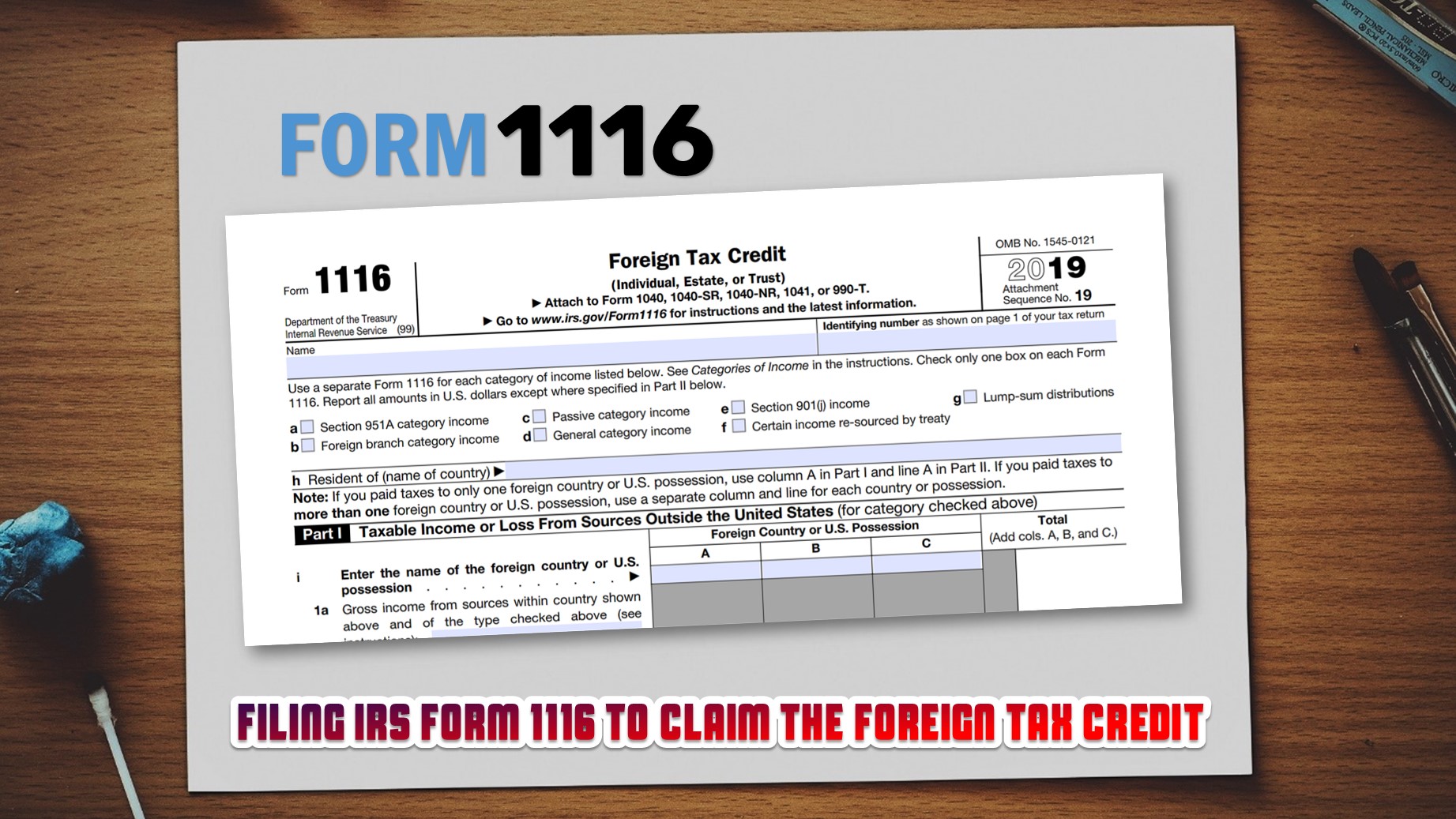

The IRS offers a way for expats to avoid paying two levels of tax on the same income. Provisions that enable this are the foreign tax credit and certain...

Expats who have foreign financial accounts may need to look into FBAR requirements. If they meet the eligibility criteria, they must file an annual informational return. Failing to do...

It is a harsh reality that the impact of COVID-19 on small businesses is devasting. The small business owners due to the shortage of cash flow have been forced...

Canada is the land of multiculturalism, immigrants, and one of the most inclusive countries in the world. To greener pastures, as they say, welcome to Canada! Therefore, we decided...

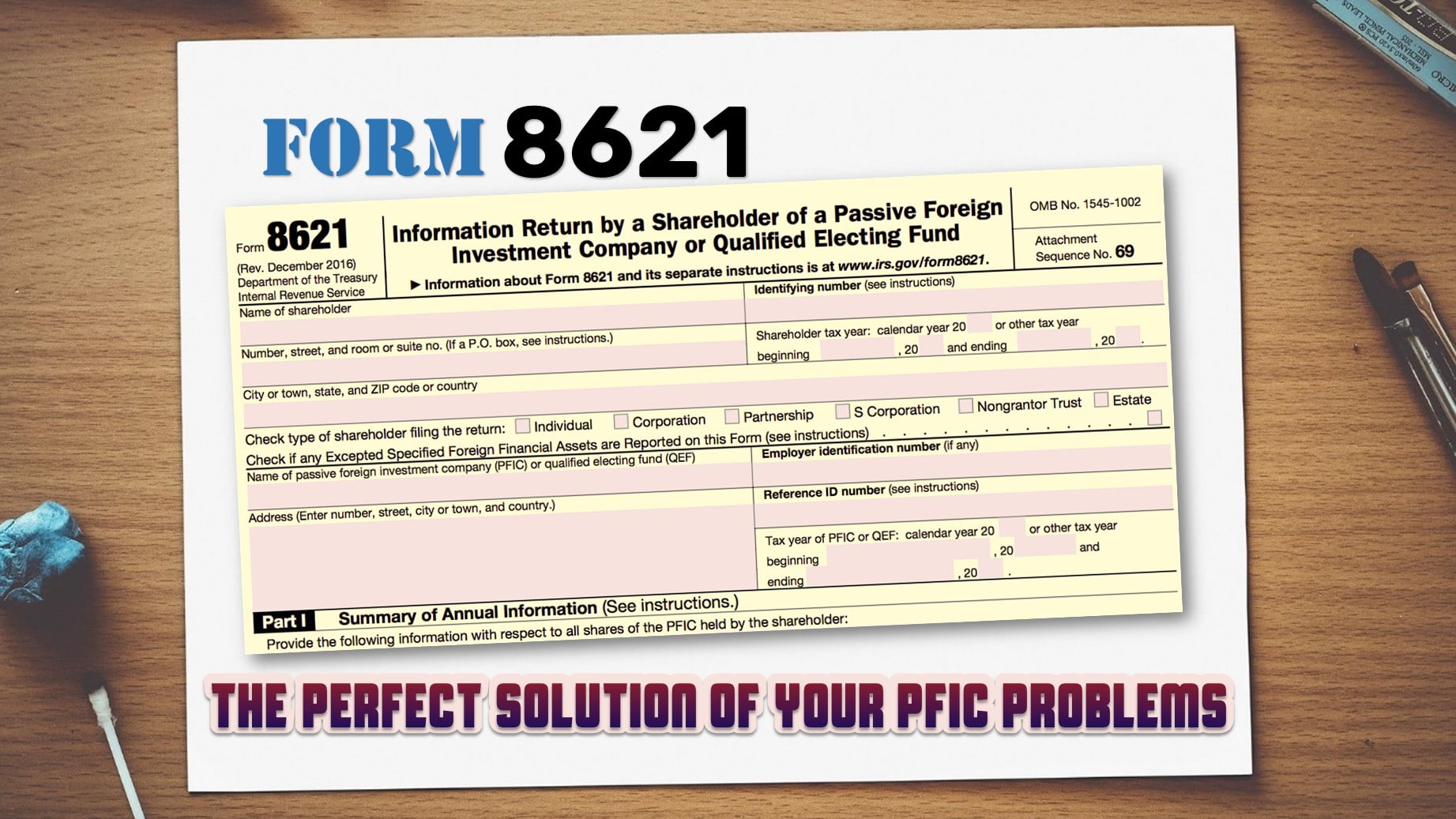

When taxpayers earn passive income from foreign investments, they often have to file Form 8621. This is the main tool for reporting earnings from PFIC companies where the taxpayer...

Every business needs proper record keeping and accounting because, without proper record keeping, your business will not hit the heights you want to achieve. To make it possible, one...

SDG Accountant‘s tutorial for clients on sharing their banking information with our firm or their accountant. These methods will allow their accountant to not lose track of any of...

What Kind of Slips is Applicable to Me or My Employees? Whereas employees generally receive T4 slips, shareholders who pay themselves dividends should be receiving T5 slips. We will...

When it comes to taxes many individuals have the tendency just to report their income and a few other expenses that they have become accustomed to collecting, such as...

Sole Proprietorship or Incorporation is one of the most frequent questions we have been asked during our initial consultation. Introduction We have recently experienced an increasing demand with regards...