Did you recently migrate to Toronto from the United States for business? If yes, you are now officially a US expat. Living overseas for professional reasons can be a...

What are Non-Fungible Tokens (NFT)? NFT stands for non-fungible tokens. NFT’s are unique digital assets that can be traded on the blockchain network. As they are non-fungible, they cannot...

Provincial Sales Tax (PST) is complicated to understand simply because different provinces have their own ways of collecting PST. In this blog post, we will be going through the...

GST/HST is an integral part of running a business, and not understanding the rules surrounding sales tax can be damaging for your business. Self-employed Canadians and businesses should be...

Cryptocurrency is a type of digital currency or payment that may be used to buy and sell goods and services on various online platforms. To work, cryptocurrencies rely on...

Brief Introduction The Government of Ontario has introduced new legislation as of October 01, 2020, bypassing Bill 45, Trust in Real Estate Act, 2020 which will bring in a...

When U.S. persons own shares or have controlling power over foreign corporations, they must file additional tax documents. Form 5471 is a perfect example and one of the most...

Form 14653 certifies an expat’s non-willfulness in case of under-reported income. It is a primary criterion of eligibility for the streamlined foreign offshore procedure. After the passage of the...

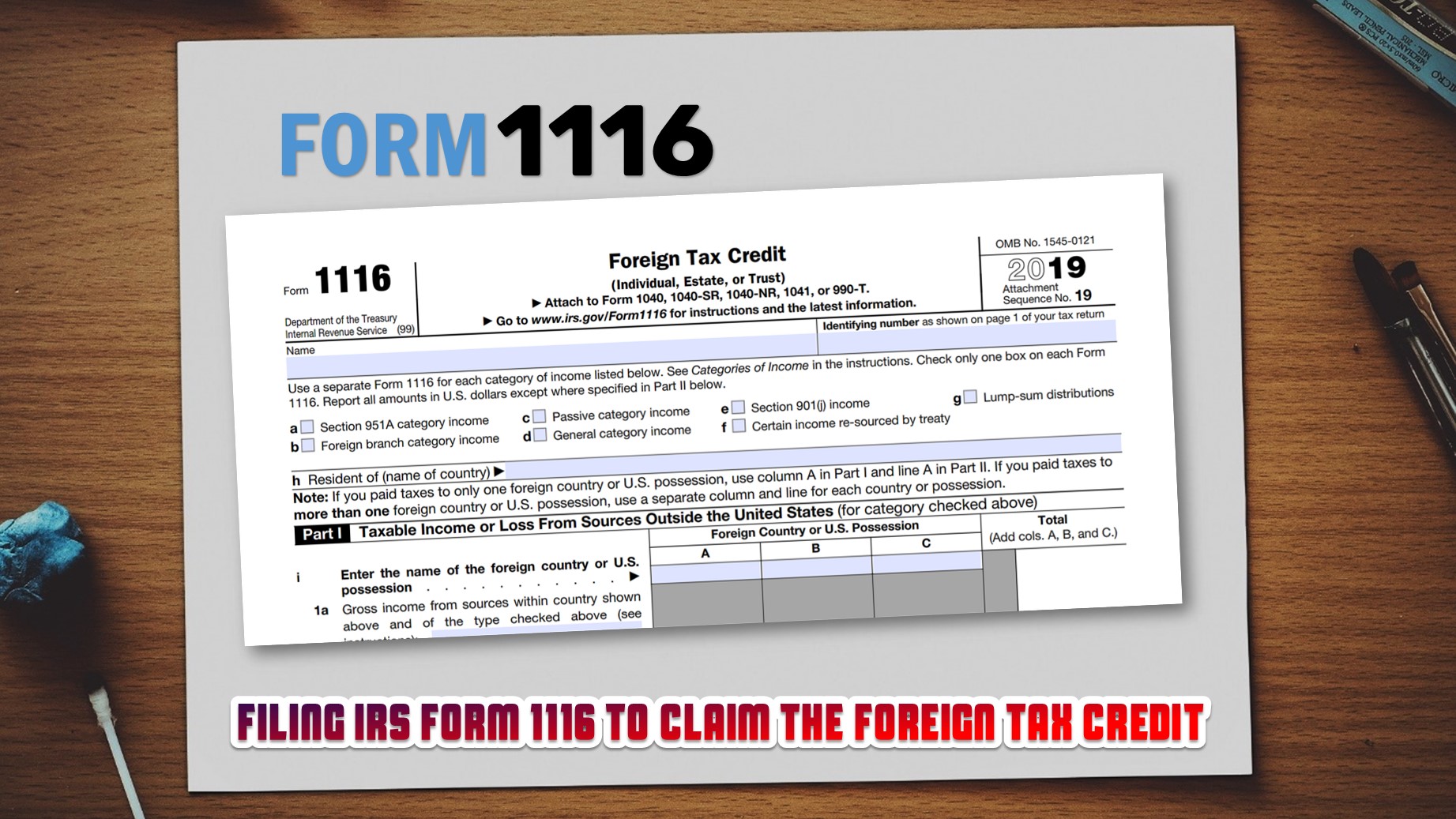

The IRS offers a way for expats to avoid paying two levels of tax on the same income. Provisions that enable this are the foreign tax credit and certain...