If you are a U.S. national who is residing outside of the country, you may find yourself facing a tricky situation surrounding the taxes on your earnings. As per the 16th Amendment, the government is within its rights to impose a nationwide tax on residents of any of the 50 states. Since the literal translation of the word “resident” would not technically apply to you, however, it seems unfair to be held liable for the said payments. The government agrees. In order to avoid double-taxation, which is one of the most dangerous pitfalls of the system, the Internal Revenue Service has established a Foreign Earned Income Exclusion (FEIE).

What Is Foreign Earned Income Exclusion?

Foreign Earned Income Exclusion (FEIE) is explained in section 911 of the 26th title of the official United States Code. Although some legalese and specialized accounting terms may be tough to get through, this is the law allowing you to sidestep paying both domestic and foreign income tax. In order to do so, it offers a full exclusion to a portion of annual earnings generated overseas. As with most other exclusions given by the IRS, it is not limitless and carries a ceiling that will be explained shortly. The FEIE is also only applicable to U.S. citizens and permanent residents who meet the predetermined eligibility requirements that involve the bona fide residence or the physical residence test.

How Do You Qualify for the Exclusion?

As per the IRS, you can qualify for the exclusion by satisfying one of the aforementioned two tests. The first one, which is the bona fide test, is based on your current status in a foreign country. It states that you may be eligible to circumvent the physical count of days spent in some other country if you have been given the status of a legal citizen or resident of that country. For instance, if you spend five years living in France, per se, you will automatically qualify for permanent residency under their immigration laws. Once you become a resident of France, earnings under the threshold will automatically be exempt from taxation in the U.S. since you meet the bona fide presence test.

Since most countries do not hand out residency or citizenship status, however, the IRS also uses the physical presence test to determine eligibility. If you spend 330 full days in a foreign country during a period of 12 consecutive months, you will be entitled to claim Foreign Earned Income Exclusion (FEIE). Many taxpayers have issues with this test because of the fact that the 12-month period does not imply a calendar year. You could actually use this test even if your foreign earnings come from a period starting in June of the first year and ending in May of the subsequent. Thus, the typical time frame that the IRS relies on, which is from January 1 to December 31, would not be relevant here. To figure out the 12-month period when there are vacations or other travels involved, the best course of action is to rely on a cross border tax accountant.

Form 2555 EZ

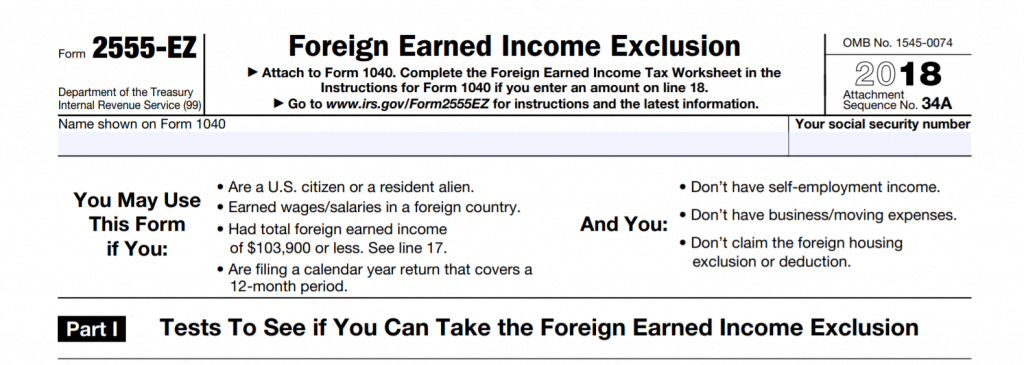

After determining that you indeed qualify for the FEIE, it is time to get into the paperwork that will let you claim the exclusion. As with every other type of tax in the U.S., there is a specialized form, Form 2555, solely created to cater to people who qualify for this exclusion. It consists of three pages and nine different parts. Taxpayers can also resort to a shorter version called Form 2555 EZ. In order to qualify for the shorter one, however, they must have no self-employment income, no business or moving expenses, and no intention of claiming the foreign housing exclusion or deduction. All of those conditions are listed alongside the basic 2555 conditions on top of the form itself. Taxpayers who are not sure if they should do Form 2555 EZ or the long version should consult a cross border tax accountant. Doing so will help avoid reporting income on the wrong form and falling victim to a prolonged procedure and additional expenses.

Non-Qualifying Types of Income

Not all income earned in a foreign country will be eligible for the FEIE. The reason why is that certain types of income are already eligible for other exclusions, deductions, or credits in either the foreign country or the U.S. Thus, allowing them to remain untaxed via the FEIE would mean that practically no tax was assessed at all. The current list of non-qualifying earnings includes:

- Previously excluded meals and entertainment;

- Pensions and annuities;

- Social security benefits;

- Any income from the U.S. Government;

- Earnings from the employer’s contribution to nonexempt trusts or non-qualified annuities.

- Recaptured moving expenses that were previously ineligible;

- Any income for which the service was already performed but cash not received.

The final bullet point simply demonstrates that the taxpayer must adhere to the accrual form of accounting when looking at their foreign income. That means that they recognize earnings when goods are transferred or services completed, not when the buyers’ payments are transmitted. Since timing issues can get moderately complex, consulting with a cross border accountant would, once again, be advised.

Who Commonly Uses the Foreign Earned Income Exclusion?

The most common group of people who use forms 2555 EZ to report cross border tax are expats. These individuals are citizens or permanent residents of the United States who no longer live within its borders. They often include those completing long-term employment projects overseas, someone who has settled and established their professional and personal life in a foreign country, and members of the military who qualify through the bona fide or physical presence tests. Those in the armed forces, however, tend to leverage “combat zone” income exclusion a lot more than they do Foreign Earned Income Exclusion (FEIE).

Choosing Between an Exclusion and a Credit

The main opponent to the foreign income tax exclusion is the foreign tax credit. The reason why is that the credit represents a dollar-for-dollar deduction of the final tax liability. An exclusion, on the other hand, is a deduction of the taxable income that has yet to be assessed for the final tax liability. So, mathematically speaking, tax credits are much more favorable due to their ability to directly impact the ultimate amount that someone owes to the government. The foreign tax credit is non-refundable and takes some fairly complex math to properly calculate. Another reason why a cross border accountant would be extremely helpful here.

In simple terms, you have to divide your foreign income by the sum of the foreign income and income earned in the United States. This fraction will represent a percentage of final tax liability that you do not have to pay. For instance, if you made $100,000 in Belgium and $100,000 in the United States, your percentage would be 50. If you end up owing $10,000 in tax liability, you will be eligible for a $5,000 foreign tax credit that puts the final assessed tax at $5,000, not $10,000. To properly calculate foreign income tax, all percentages, as well as the amount due, however, you should always let your math skills take a backseat to a cross border tax accountant who has professional experience in the area.

Current Limitations

Filling a 2555 EZ will not allow you to momentarily exclude every single dollar earned somewhere outside of the U.S. The reason why is that there are ceiling figures above which no taxpayer is allowed to go. The way that that number is calculated is by multiplying $80,000, which was the exclusion maximum in 2005, by the current inflation rate. Doing so will adjust it for the current year and let the taxpayer exclude proportionally the same amount of money as everyone else who used the exclusions under their own inflation rates in years prior. In 2018, the maximum was $103,900. For those who will file 2555 EZ next year to exclude foreign income earned in 2019, the maximum will be $2,000 higher at $105,900. After all, cross border tax is still subject to the same worldwide inflation and cost-of-living adjustments.

Timeliness Concerns: Getting an Extension for the Foreign Earned Income Exclusion

Since taxpayers who reside in the U.S. have the right to file for an extension, those living elsewhere will retain that same right. In order to remain eligible for the FEIE when you do not have enough time to turn in the proper paperwork, you can file Form 2350. This is known as the “Application for Extension of Time to File U.S. Income Tax Return” that will postpone your paperwork’s due date to June 15. Note that the anticipated liability must still be paid by April 15 to avoid penalties on both domestic and cross border tax. Even a small error on the extension form could undermine the venture and result in pricey lessons. The best way to avoid them? Work with a cross border accountant who knows all the ins and outs of the filing process and understands the trade-off between the timeliness and potential exclusion.

The information is not intended to constitute professional advice and may not be appropriate for a specific individual or fact situation. It is written by the author solely in their personal capacity and cannot be attributed to the accounting firm with which they are affiliated. It is not intended to constitute professional advice, and neither the author nor the firm with which the author is associated shall accept any liability in respect of any reliance on the information contained herein. Readers should always consult with their professional advisors in respect of their particular situations.

— Sami Ghait

CPA, CGA