Cryptocurrency is a type of digital currency or payment that may be used to buy and sell goods and services on various online platforms. To work, cryptocurrencies rely on...

Brief Introduction The Government of Ontario has introduced new legislation as of October 01, 2020, bypassing Bill 45, Trust in Real Estate Act, 2020 which will bring in a...

When U.S. persons own shares or have controlling power over foreign corporations, they must file additional tax documents. Form 5471 is a perfect example and one of the most...

Form 14653 certifies an expat’s non-willfulness in case of under-reported income. It is a primary criterion of eligibility for the streamlined foreign offshore procedure. After the passage of the...

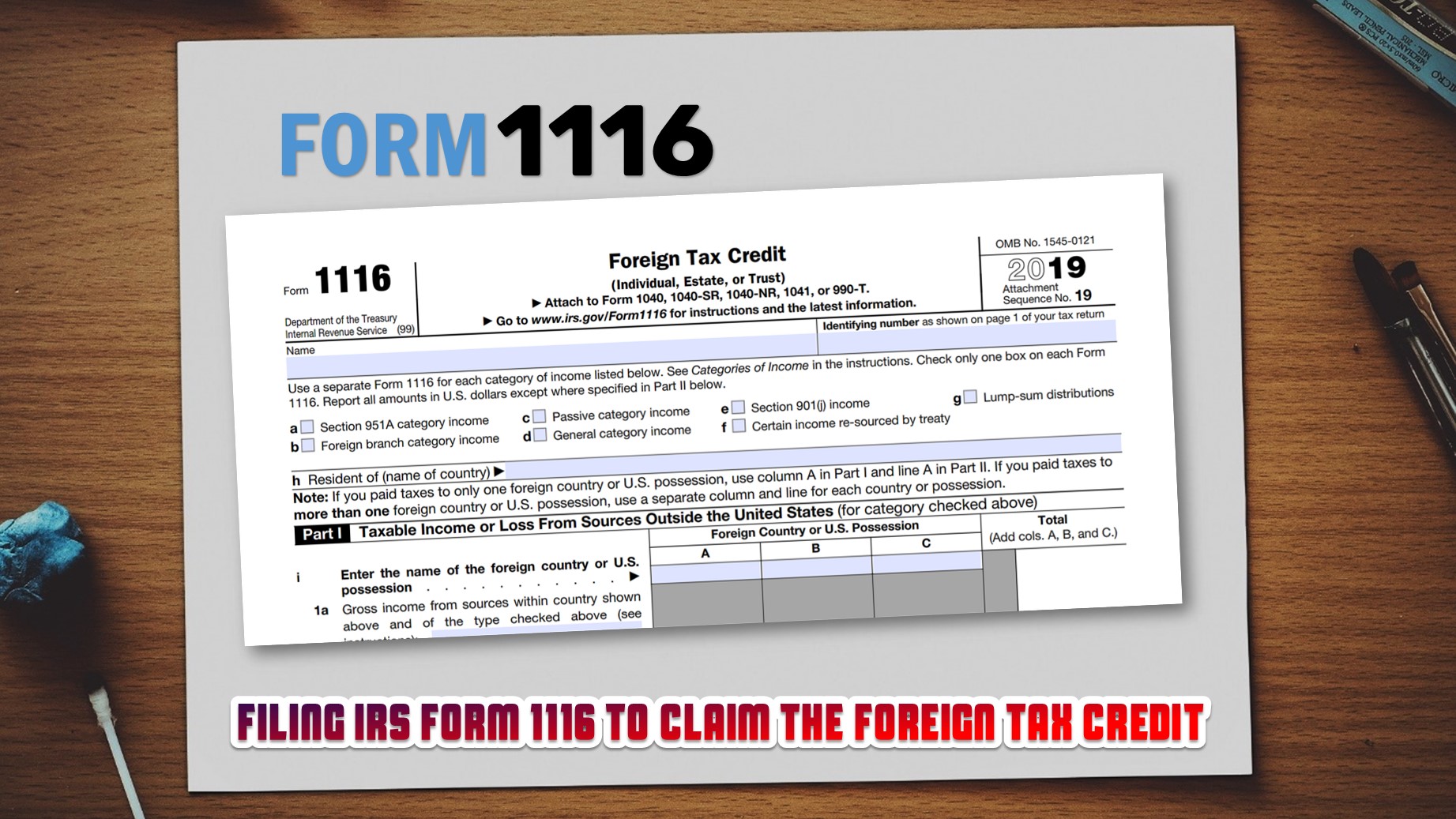

The IRS offers a way for expats to avoid paying two levels of tax on the same income. Provisions that enable this are the foreign tax credit and certain...

Canada is the land of multiculturalism, immigrants, and one of the most inclusive countries in the world. To greener pastures, as they say, welcome to Canada! Therefore, we decided...

If you are a U.S. national who is residing outside of the country, you may find yourself facing a tricky situation surrounding the taxes on your earnings. As per...

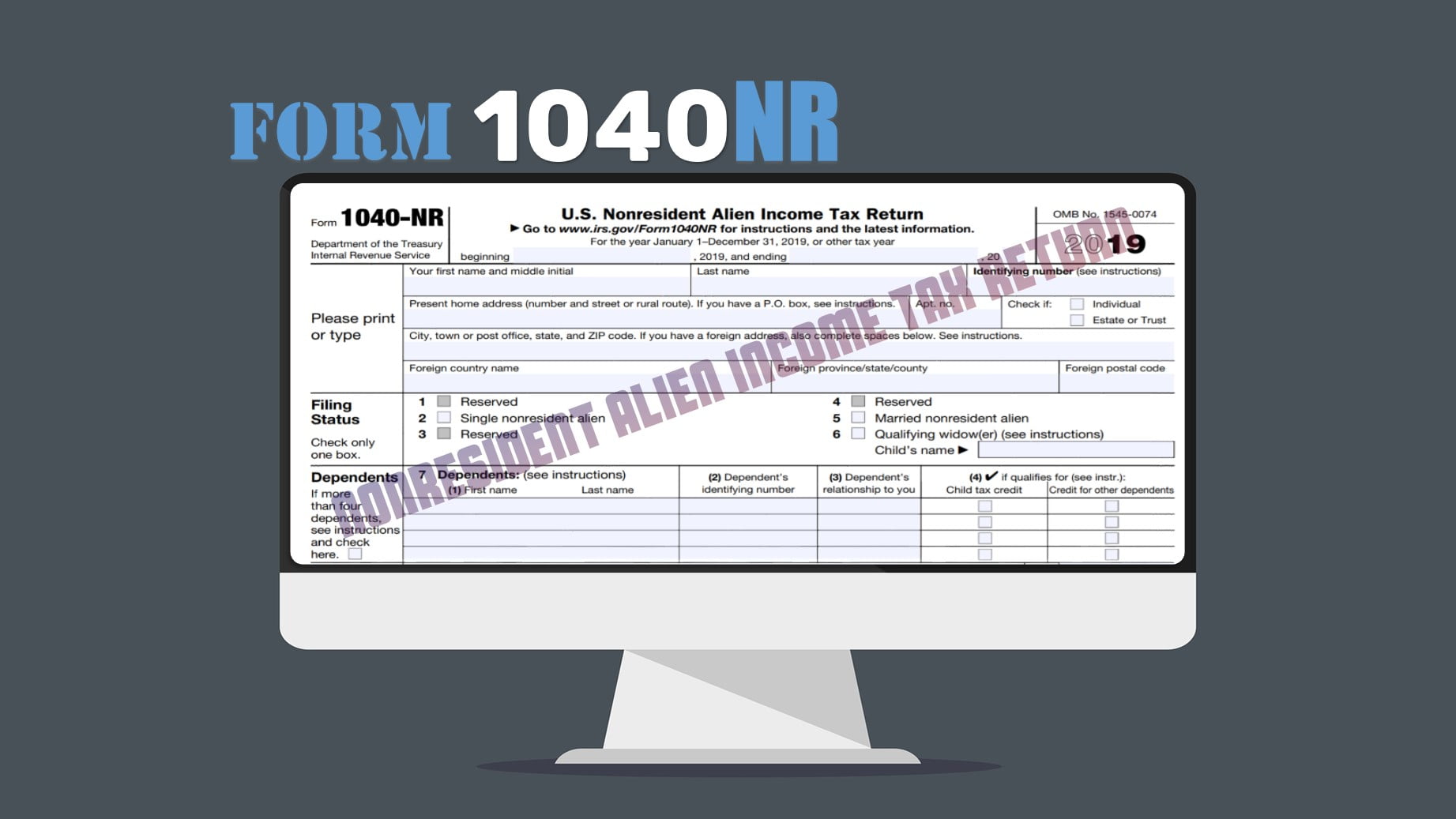

As one of the most complex tax situations that you could find yourself in, figuring out the way to report earnings as a non-resident alien of the United States...

When taxpayers earn passive income from foreign investments, they often have to file Form 8621. This is the main tool for reporting earnings from PFIC companies where the taxpayer...