Canada is the land of multiculturalism, immigrants, and one of the most inclusive countries in the world. To greener pastures, as they say, welcome to Canada! Therefore, we decided...

If you are a U.S. national who is residing outside of the country, you may find yourself facing a tricky situation surrounding the taxes on your earnings. As per...

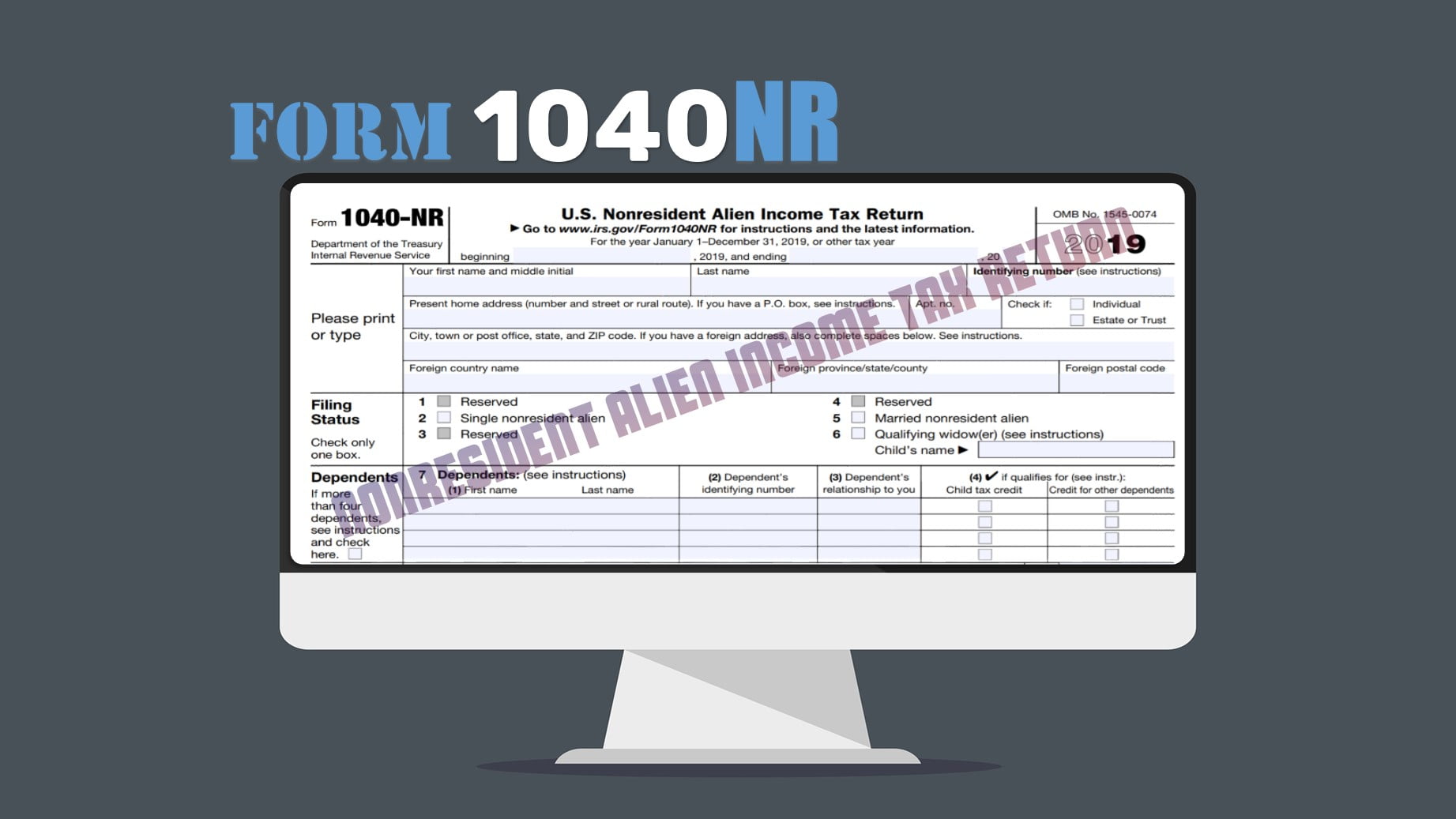

As one of the most complex tax situations that you could find yourself in, figuring out the way to report earnings as a non-resident alien of the United States...

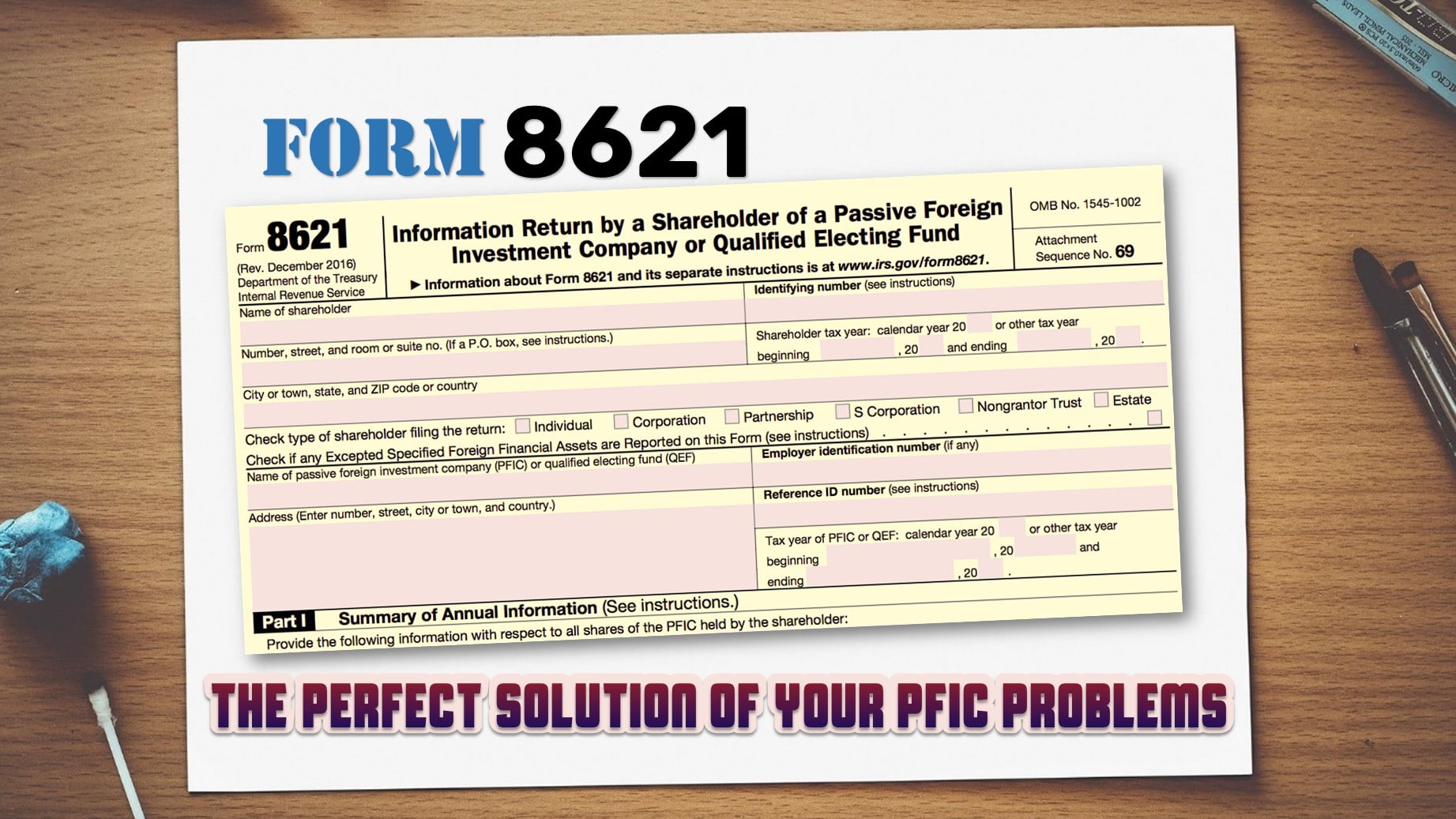

When taxpayers earn passive income from foreign investments, they often have to file Form 8621. This is the main tool for reporting earnings from PFIC companies where the taxpayer...

As of 2016, there were roughly nine million Americans living in foreign countries. These were individuals pursuing professional careers or personal objectives in areas far outside the nation’s borders....

Every business needs proper record keeping and accounting because, without proper record keeping, your business will not hit the heights you want to achieve. To make it possible, one...

What is the Difference Between US Citizens and Green Card Holders When it Comes to Taxes? When it comes to filing federal taxes, there is pretty much no difference...

What Kind of Slips is Applicable to Me or My Employees? Whereas employees generally receive T4 slips, shareholders who pay themselves dividends should be receiving T5 slips. We will...

SDG Accountant team provides an introduction on tax credit and various issues. The information is not intended to constitute professional advice and may not be appropriate for a specific...

When it comes to taxes many individuals have the tendency just to report their income and a few other expenses that they have become accustomed to collecting, such as...