GST/HST is an integral part of running a business, and not understanding the rules surrounding sales tax can be damaging for your business. Self-employed Canadians and businesses should be aware that they might need to register for a GST/HST account and start remitting sales tax to the CRA.

What is the Difference Between GST, HST and PST?

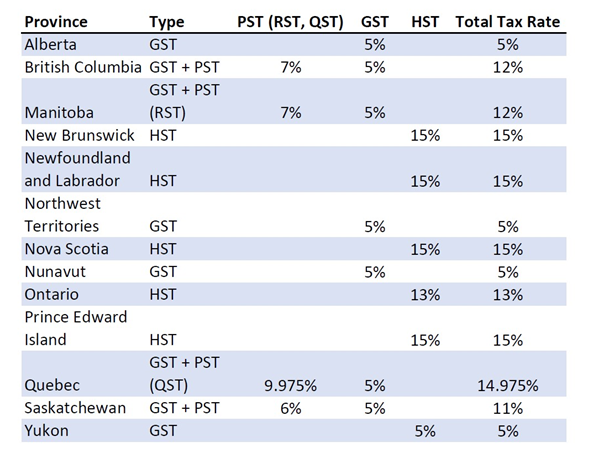

There are three different types of sales tax in Canada:

- GST (Good and Services Tax)

- PST (Provincial Sales Tax) – In Manitoba, PST is also known as RST while in Quebec, it is known as QST

- HST (Harmonized Sales Tax) – HST is a combination of PST and GST. From the chart below, provinces and territories who collect HST, don’t collect GST and PST separately.

Below is a chart that composes all the different sales tax and their specific rates in each province and territory:

GST/HST

How do I know if I Need to Charge GST/HST?

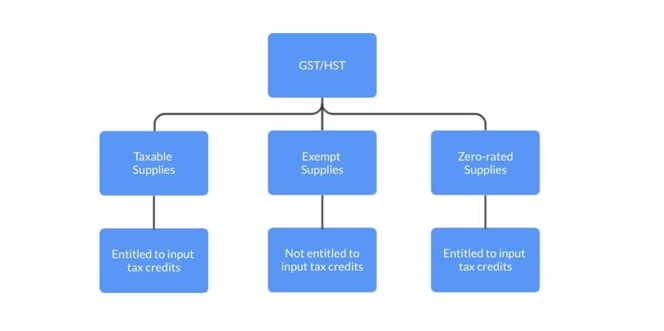

For most businesses, GST and HST apply to most goods and services. GST applies to real property (land, building) and intangible property (trademarks, patents). These are known as taxable supplies.

However, some goods and services are exempt from GST/HST and are known as exempt supplies. There are also goods and services that have a GST/HST rate of 0%, they are known as zero-rated supplies.

Once, you have established whether your goods and services are taxable, exempt or zero-rated supplies. You can now determine if you need to start charging GST/HST and remitting it to the CRA by filing a GST/HST return.

At SDG Accountant, our accountants can determine whether or not your business is required to charge GST and HST! We assist in filing GST/HST returns as well. For more information, admin@sdgaccountant.com for assistance or schedule a free consultation.

What is the Difference Between Taxable, Exempt and Zero-Rated Supplies?

The significant difference between them is their entitlement to input tax credits which will be explained in the following section.

What are Input Tax Credits (ITC) and Why are They Useful?

When filing your GST/HST return, your business can claim a sum of GST/HST paid on purchases and expenses for your business. These are known as input tax credits (ITC) and are extremely useful!

The only purchases and expenses which your business cannot claim ITC are:

- Certain capital property

- Membership fees or dues to any club whose primary purpose is to provide recreation, dining or sporting facilities such as (fitness club, golf clubs, hunting and fishing clubs)

- Property or service you bought for your own benefit and enjoyment, in other words, not for business purposes

At SDG Accountant, our accountants are trained to help clients with GST/HST returns. We can help claim the input tax credits to help your business get a sum of money back.

When do I start charging GST/HST and remitting it to the CRA?

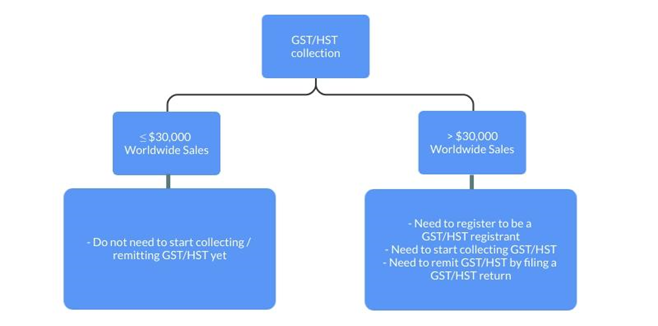

If your business has identified that it is selling taxable supplies and zero-rated supplies, your business will need to determine if it is a small supplier or not.

A small supplier means a business that makes less than or equal to $30,000 Worldwide sales per year. Although selling taxable and zero-rated supplies, small suppliers do NOT need to charge GST/HST and remit sales tax yet.

The moment a business makes more than $30,000 in Worldwide sales, they are NOT considered a small supplier. Once a business is no longer a small supplier, they have to be a GST/HST registrant, start charging GST/HST and remit sales tax to the CRA by filing a GST/HST return.

If your business did not start collecting GST/HST or sign up to be a GST/HST registrant the day the threshold of $30,000 in Worldwide Sales was exceeded, SDG Accountant is able to help assist clients with the process. If your business did not start collecting GST/HST or sign up to be a GST/HST registrant the day the threshold of $30,000 in Worldwide Sales was exceeded, SDG Accountant is able to help assist clients with the process. For more information, admin@sdgaccountant.com for assistance or book a free consultation.

The information is not intended to constitute professional advice and may not be appropriate for a specific individual or fact situation. It is written by the author solely in their personal capacity and cannot be attributed to the accounting firm with which they are affiliated. It is not intended to constitute professional advice, and neither the author nor the firm with which the author is associated shall accept any liability in respect of any reliance on the information contained herein. Readers should always consult with their professional advisors in respect of their particular situations.

— Sami Ghaith

CPA,

CGA, MBA