Provincial Sales Tax (PST) is complicated to understand simply because different provinces have their own ways of collecting PST. In this blog post, we will be going through the different rules surrounding PST in regards to the different provinces.

What is the Difference Between GST, HST and PST?

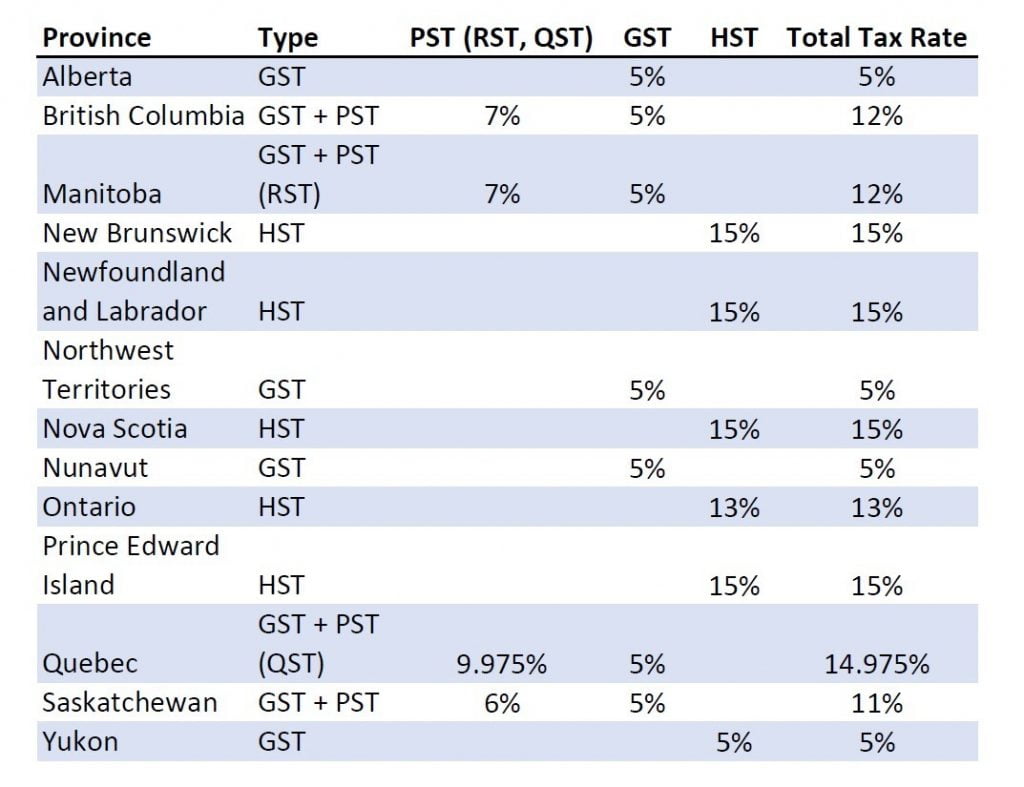

There are three different types of sales tax in Canada:

- GST (Good and Services Tax)

- PST (Provincial Sales Tax) – In Manitoba, PST is also known as RST, while in Quebec, it is known as QST

- HST (Harmonized Sales Tax) – HST is a combination of PST and GST. From the chart below, provinces and territories that collect HST, don’t collect GST and PST separately.

It is important not to confuse GST/HST with PST (RST & QST) as GST/HST is a federal sales tax while PST is provincial. Businesses must take note of this and do the appropriate sales tax filings.

Just in case, if you wanted to learn more about GST/HST, we wrote a summative blog post about it as well.

Below is a chart that composes all the different sales tax and their specific rates in each province and territory:

What are the Provinces and Territories that Collect PST?

- British Columbia – 7%

- Manitoba – Also known as Retail Sales Tax (RST) at 7%

- Quebec – Also known as Quebec Sales Tax (QST) at 9.975%

- Saskatchewan – 6%

How do I Know if I Need to Charge Provincial Sales Tax (PST)?

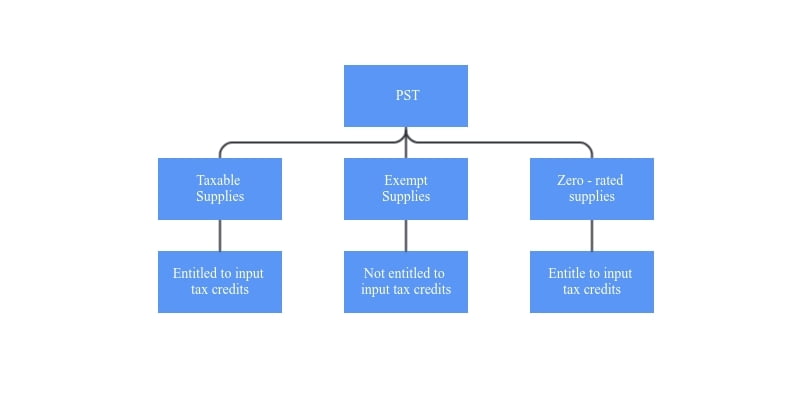

For most businesses, Provincial Sales Tax (PST) applies to most goods and services and they are known as taxable supplies.

However, some goods and services are exempt from PST and are known as exempt supplies. There are also goods and services that have a PST of 0%, they are known as zero-rated supplies.

What are Input Tax Credits (ITC) and Why are they Useful?

When filing your PST return, your business can claim a sum of GST/HST paid on purchases and expenses for your business. These are known as input tax credits (ITC) and they are extremely useful to get some money back.

(a) British Columbia PST

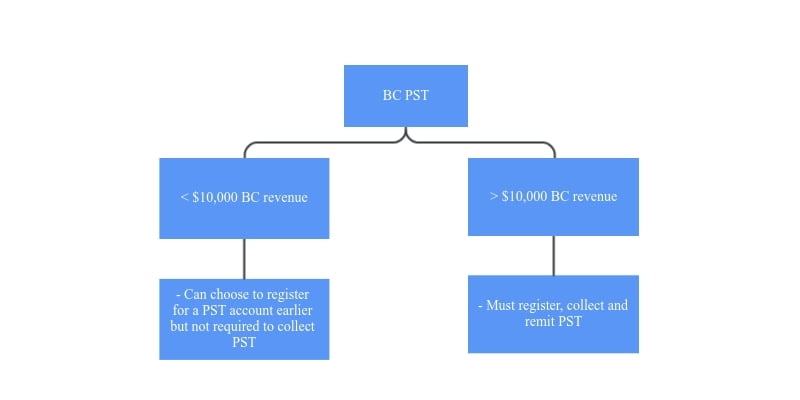

Effective since April 1, 2021, most businesses (within or outside Canada) must register for a PST account and remit PST to the BC government (unless exempt) as long as the business has exceeded the minimum BC revenue threshold of $10,000.

This means that businesses that made over $10,000 in revenue from BC consumers must register for a PST account and remit PST (by filing a PST return).

Businesses can voluntarily choose to register for a PST account even before they meet the BC revenue threshold. They have the choice of not collecting until the BC $10,000 revenue threshold has been reached.

The filing frequency will depend on the average PST collected.

Exempt from BC Provincial Sales Tax (PST):

PST does not need to pay for:

- Bicycles

- Food (Groceries and restaurant meals)

- Children clothing

- Prescription medicines and household medical aids

- Books, newspapers, and magazines

- Sales of real property such as residential housing or commercial real estate

- Leases of real property (bare land, farmland, retail and commercial space, storage space, and long-term accommodation (over one month))

- Membership or event admission (such as tickets, and passes to sporting/music events)

- Non-taxable or exempt services (such as transportation, dry cleaning, financial, consulting and management services)

Business with inventory held in BC

You must register (before you sell goods held in inventory), collect and remit BC PST if you do all of the following:

- Sell taxable goods to customers in BC

- Accept orders from customers located in BC

- Hold the goods you sell to your BC customers in inventory in BC at all times of sales

How to Register for BC PST?

- Online: Using eTaxBC

- In person: Visit the nearest Service BC Centre

- By fax or mail: The application FIN 418 (Registration for Provincial Sales Tax must be completed. Fax number is 250-356-2195 while mailing address is Ministry of Finance, PO Box 9435 STN Prov Gov, Victoria BC V8W 9V3

How does my Business Remit BC PST?

Similar to filing a GST/HST return, the BC PST return can be filed electronically using eTaxBC.

(b) Manitoba PST (RST – Retail Sales Tax)

Unlike British Columbia, there is no revenue threshold for a business to meet before a business must start collecting RST. All taxable goods and services must charge RST (unless exempt).

All vendors must be RST registrants before they are able to sell or provide taxable goods and services.

The filing frequency will depend on the average RST collected. Annually if collected less than $500 RST but monthly if $5,000 and more.

Examples of Exempt Goods:

- Agricultural feeds

- Baby supplies

- Children clothing

- Food

- Medicine (Drugs sold on prescription)

- Food and beverages that are exempted as “basic groceries” under GST

- Female hygiene products (Tampons, pads, menstrual cups)

How to Register for BC Provincial Sales Tax (PST)?

- Online: Using TAXcess

- In person: Visit the nearest Taxation Tax Division Office

(c) Quebec PST (QST – Quebec Sales Tax)

Businesses that surpass the worldwide revenue of $30,000 need to register and collect QST from their consumers (unless exempt). This is similar to the BC PST threshold except the difference is that BC’s threshold revenue of $10,000 is revenue amounts made in BC only while the QST $30,000 threshold is revenue not limited to Quebec.

Mandatory QST Registration:

- Tobacco at retail

- Fuel at retail

- Alcoholic beverages

- Sell or lease of new tires

- Sell or lease of new or used vehicles

Exempt Goods:

Goods exempt from QST is the list of goods exempted from GST/HST

Examples of exempt goods and services are:

- Services by public sector bodies

- Most financial services

- Most health, education, childcare and legal service aid

- Sales of most residential complexes (not new)

How to Register for QST?

- Online: Using My Account for businesses

- Call line: List of telephone numbers

- By mail: List of mailing addresses

How does my Business Remit QST?

Businesses can do this online using theMy Account for businesses or My Account for individuals.

(d) Saskatchewan PST

All businesses in Saskatchewan (resident or not) must be a PST registrant before they can conduct any sales (unless exempt or small supplier).

The filing frequency will depend on the average PST collected.

What is a Small Supplier:

- Less than annual sales $10,000

- Produces and sells good in their residence on a small scale or non-commercial basis

As long as these two criteria are met, the business does not need to be a PST registrant. The moment the business conducts business outside of their residence or sells to commercial customers, they are required to then collect PST.

What is Exempt from Provincial Sales Tax (PST)?

- Basic grocery

- Books & magazines

- Agricultural equipment

- Prescription drugs

- Healthcare services

- Spas’ / Beauty Salon/ Tattooing services

- Some training services

- Some consulting services (management & consulting)

- Limousine services

How to Register for Provincial Sales Tax (PST) in Saskatchewan?

- Online: Using SETS

- Mail: Fill up the Application for Vendor’s Licence/Consumer Permit and submit it to Ministry of Finance, Revenue Division, PO BOX 200, Regina, SK, S4P 2Z6

- Email: Fill up the Application for Vendor’s Licence/Consumer Permit and submit it to SaskTaxInfo@gov.sk.ca

How to Remit Provincial Sales Tax (PST)?

Businesses can remit PST using the online service SETS

At SDG Accountant, our accountants are trained to help clients with GST/HST and Provincial Sales Tax (PST) returns. We can help claim the input tax credits to help your business get a sum of money back. For more information, admin@sdgaccountant.com for assistance or book a free consultation.

The information is not intended to constitute professional advice and may not be appropriate for a specific individual or fact situation. It is written by the author solely in their personal capacity and cannot be attributed to the accounting firm with which they are affiliated. It is not intended to constitute professional advice, and neither the author nor the firm with which the author is associated shall accept any liability in respect of any reliance on the information contained herein. Readers should always consult with their professional advisors in respect of their particular situations.

— Sami Ghaith

CPA,

CGA, MBA