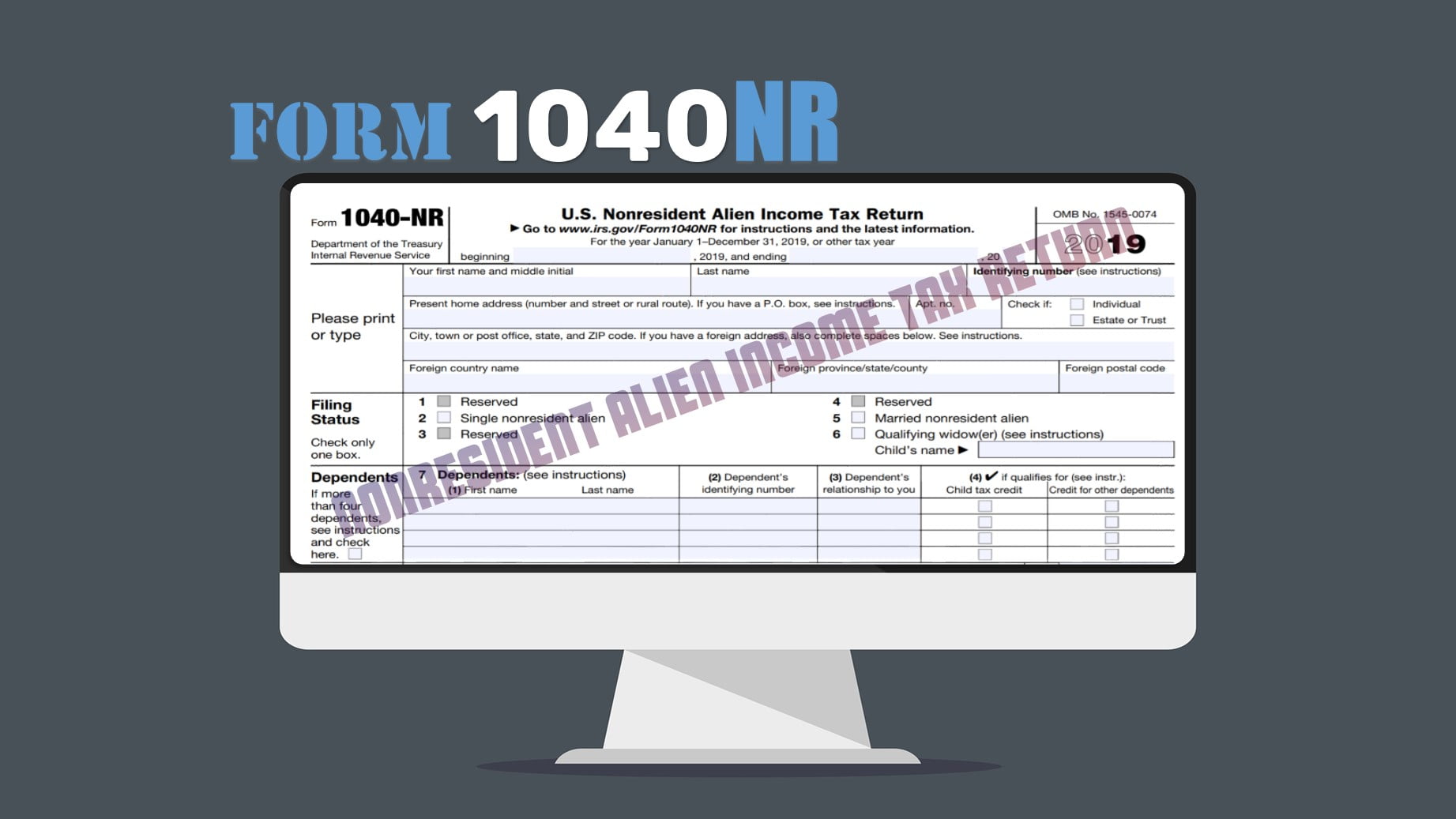

As one of the most complex tax situations that you could find yourself in, figuring out the way to report earnings as a non-resident alien of the United States...

The CRA Voluntary Disclosure Program grants relief to taxpayers who voluntarily omitted or made an error on their tax returns. In the program, taxpayers can correct or make changes...

Are you an American living in Canada who has never filed U.S. tax returns? How about F-bars? You may be in trouble as the IRS may take extreme measures...

Introduction In a country where the middle class dominates a majority of the population and can earn anywhere between $23,357 up to $55,498 for individuals and $38,755 to $125,009 for families of two or...

Recently Trump administration and Congressional Republican leaders released the Unified Framework with regards to the U.S tax reform. This Framework has highlighted the major changes including lower personal tax...