Are you a foreign person who needs to file taxes in the United States? If so, you may need to apply for an individual taxpayer identification number (ITIN) by filing a Form W-7 with the Internal Revenue Service (IRS). In this article, SDG describes ITIN for Canadians, and here’s what you need to know about preparing and filing a Form W-7.

Step 1: Determine Your Eligibility for an ITIN

An ITIN is a nine-digit number that the IRS assigns to individuals who are not eligible for a Social Security number but have a requirement to file a U.S. tax return. To be eligible for an ITIN, you must meet the following criteria:

- You are not eligible for a Social Security number

- You have a requirement to file a U.S. tax return

- You are a nonresident alien who is not eligible for a U.S. driver’s license

- You are a resident alien who is not eligible for a Social Security number

Step 2: Gather the Necessary Documents

To apply for an ITIN, you will need to provide proof of your foreign status and identity. Acceptable documents include a passport, national identification card, or birth certificate. A complete list of acceptable documents is available on the Form W-7 instructions.

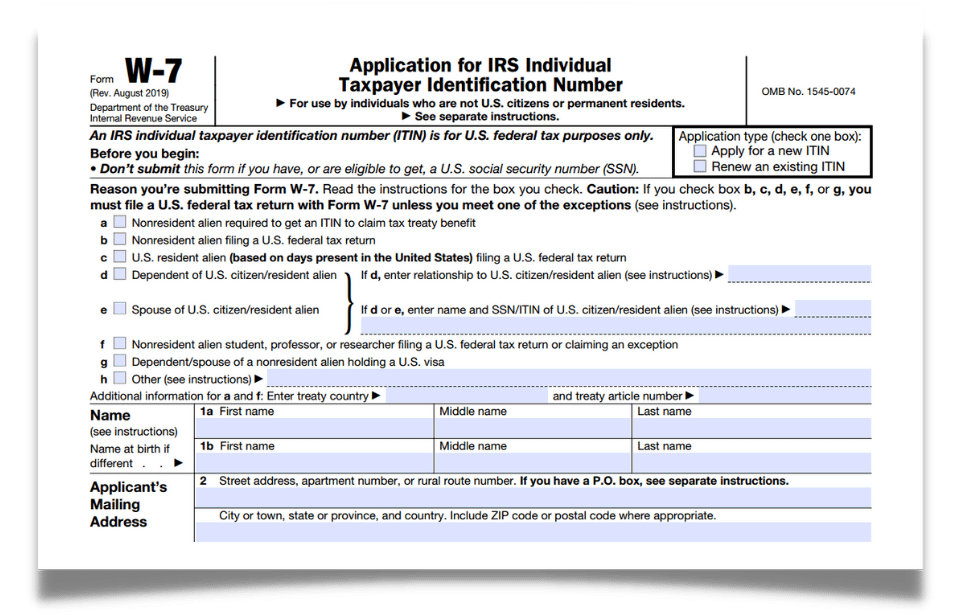

Step 3: Fill Out Form W-7

The next step is to fill out Form W-7. The form requires personal information such as your name, date of birth, and mailing address. You will also need to provide information about your immigration status and explain why you need an ITIN.

Step 4: Attach the Required Documents

Once you have filled out Form W-7, you will need to attach the necessary documents to support your application. These documents must be either original or certified copies. Do not send original documents unless specifically instructed to do so by the IRS.

Step 5: Submit Your Application

Once you have completed Form W-7 and attached the necessary documents, you can submit your application to the IRS. You can either mail your application to the address listed in the instructions or submit it in person at an IRS Taxpayer Assistance Center.

Step 6: Wait for Your ITIN

After you submit your application, it may take several weeks for the IRS to process it and assign you an ITIN. You can check the status of your application online using the IRS’s Where’s My ITIN? tool.

Conclusion

In the end, filing a Form W-7 is a necessary step for foreign nationals who need to file taxes in the United States. By following these steps, you can prepare and submit your application with confidence, knowing that you have provided all the necessary information and documents. If you have any questions or concerns about the ITIN application process, consult a qualified tax professional or seek assistance from the IRS.

For more information, please book a free consultation

The information is not intended to constitute professional advice and may not be appropriate for a specific individual or fact situation. It is written by the author solely in their personal capacity and cannot be attributed to the accounting firm with which they are affiliated. It is not intended to constitute professional advice, and neither the author nor the firm with which the author is associated shall accept any liability in respect of any reliance on the information contained herein. Readers should always consult with their professional advisors in respect of their particular situations.

— Sami Ghaith

CPA, CGA, MBA